What is should cost analysis?

Should cost analysis is a strategic approach to reducing the prices paid for parts and products by estimating the true manufacturing cost—then using that estimate to set realistic targets and negotiate with a shared, data-driven fact base.

Instead of forcing arbitrary price cuts, should-cost turns negotiation into an engineering-informed discussion about the drivers of cost.

- Price ≠ cost. Quotes reflect commercial context; cost models explain what drives the number.

- Targets become defensible. Point to cycle time, yield, tooling, and routing—not opinions.

- Better conversations. Isolate the exact assumption causing the gap and resolve it.

On this page

Benefits and strategy

Many organizations set cost-reduction targets top-down and expect suppliers to comply. Without understanding underlying costs, that often becomes an argument about price—rather than a discussion about what truly drives manufacturing cost.

Should cost analysis closes that gap by comparing supplier quotes to an independent estimate of what the part should cost to make.

- Better outcomes: savings come from real cost drivers, not strained relationships.

- Faster alignment: procurement, engineering, and suppliers discuss the same assumptions.

- More resilient supply base: targets are achievable without pushing efficient suppliers into unsustainable margins.

What-if scenario modeling

DFMA Should Costing provides transparent access to an extensive database of manufacturing labor, materials, methods, and machinery costs—built via decades of research and continually optimized by experts.

- What if the region of manufacture changed?

- What if material prices went up or down by X%?

- What if the supplier used a different machine?

- What if we used a different material?

- What if we used different sheet sizes for sheet metal parts?

- What impact does the percentage of regrind have on injection-molded parts?

- What if labor rates increase or decrease by X%?

Everything you need to calculate real-world manufacturing costs is accessible, including the ability to access the underlying database to adjust inputs and immediately see the effect changes have on the resultant costs.

The important difference between price and cost

A common pitfall is relying on historical price as a proxy for cost. Historical pricing reflects past deals, volumes, market timing, and supplier strategy—it does not reflect the cost structure of a new part or routing.

Should cost analysis removes the anchoring effect of historical prices by focusing on materials, processing, setup, tooling, and yield. Negotiation then becomes a targeted discussion: where does the model differ from the quote, and which assumption explains the gap?

- What you paid before

- Past volumes and market timing

- Previous supplier strategies

- What drives the cost today

- Which assumptions explain gaps

- Where to focus negotiation

Key components of should cost analysis

DFMA Should Costing breaks down the cost of a part into process & setup, material, tooling, and profit components, each calculated with rigorous detail.

Process and Setup Costs

These costs are based on the hourly charge-out rates for a typical supplier—essentially modeling the scenario in which your company rents a machine and operator for the time needed to produce its parts.

- Machine depreciation

- Energy and consumables

- Floor-space allocation

- Selling, general, and administrative overhead

- Fully burdened labor for operators and maintenance

- Supplier profit for running the operation

Material Cost

A should-cost estimate uses fully burdened material cost per unit weight. DFMA models the supplier as an intermediary purchasing raw material, then selling that material to you in the form of finished parts.

- The base purchase price of the material

- Delivery to the supplier

- Administrative tracking within the facility

- Profit to compensate for buying, handling, and selling

Tooling Cost

Tooling costs are estimated from tool-supplier charge-out rates, which capture machine, consumable, and toolmaker labor costs—including profit. The model assumes your company rents equipment, purchases supplies, and hires a toolmaker for the time required to produce dedicated tooling.

Supplier Profit (Why a Single % Can Mislead)

The simplest way to account for supplier profit is a flat percentage of total manufacturing cost, but this approach ignores the varying levels of value-added labor across parts.

DFMA advocates applying separate profit margins to each cost component:

- Higher margins to setup and processing (reflecting labor and capital intensity)

- Lower margins to material (reflecting pass-through costs)

- Adjusted margins for dedicated tooling to reflect low production volumes

This ensures fairer cost distribution and prevents overpayment for parts with minimal value-added processes.

Real-world case study

Plastic Clip Assembly: $361,000 Annual Savings

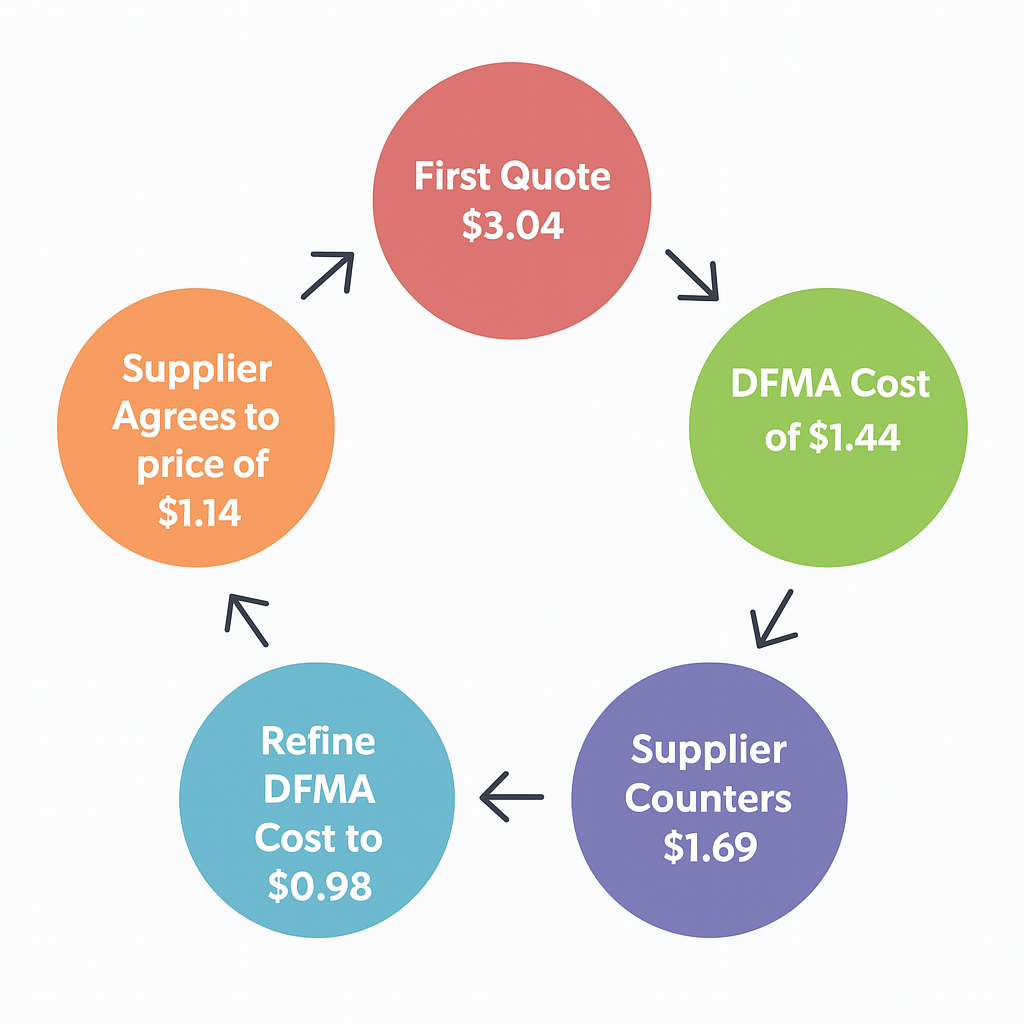

A supplier quoted $3.04 to produce a plastic clip assembly. Using DFMA Should Costing:

- The analysis revealed the true manufacturing cost

- This enabled a fact-based, data-driven negotiation

- The company achieved $361,000 in annual savings on this single assembly

Many customers report savings in the millions using DFMA across their product portfolios.

Negotiating with suppliers using DFMA

Generate precise cost estimates in real-time and focus on the true drivers of cost to assess whether a supplier's quote is justified. The software translates complex cost data into a format suppliers readily understand, fostering a transparent and fair supplier-costing process.

- Cycle time

- Setup

- Yield

- Tooling

- Routing

- Overhead

- "Which operation is longer?"

- "Which tolerance/finish is driving this?"

- "What's the setup assumption?"

- Present assumptions in a consistent format

- Suppliers recognize the methodology

- Focus on drivers, not opinions

Implementing should cost analysis in your organization

Adopting DFMA Should Costing requires a strategic commitment to data accuracy, cross-functional collaboration, and continuous improvement:

- Establish a cross-functional team—involve procurement, engineering, finance, and manufacturing to ensure all perspectives are covered.

- Invest in advanced costing tools—leverage software such as DFMA Should Costing for accurate, real-time estimates.

- Develop detailed cost models—break down each part's cost structure to compare quotes and pinpoint savings.

- Train your team—ensure stakeholders understand should-cost methodologies and tools.

- Foster transparent supplier relationships—promote open communication and data sharing.

- Monitor and adjust—continually track performance and refine strategies as markets and processes evolve.

Benefits of implementing should cost analysis

- Cost Reduction: Savings based on true manufacturing costs

- Increased Profit Margins: Lower part costs boost profitability

- Improved Supplier Relationships: Transparency and mutual understanding

- Enhanced Negotiation Power: Accurate data drives effective negotiations

- Supply-Chain Resilience: Fair pricing keeps suppliers healthy

Frequently asked questions

What is should cost analysis?

It's a method for estimating true manufacturing cost—then using it to set realistic cost targets and negotiate supplier pricing based on transparent drivers.

Why is it better than using historical prices?

Historical prices are anchored to past deals and conditions. Should-cost models materials, processing, setup, tooling, and yield so negotiations focus on what drives cost today.

What cost components are typically included?

Most should-cost models include material cost, processing and setup time (using chargeout rates), tooling and amortization, scrap/yield, and an explicit profit approach that reflects value-added work.

How does should cost analysis help supplier negotiations?

It turns negotiations into a problem-solving discussion: identify where estimates differ (cycle time, tooling assumptions, yields, overhead, secondary ops), then align on the drivers that explain the gap.

What's the fastest way to start?

Pick 10–20 high-spend parts, build baseline models, and use them to structure supplier conversations. A cross-functional review cadence makes it repeatable.

Which teams should be involved?

The strongest should-cost programs are cross-functional, typically involving procurement, engineering, manufacturing, and finance so both technical feasibility and commercial outcomes are covered.

Ready to optimize your should costing process?

If you want defensible targets and faster alignment across procurement and engineering, we can walk through how should-cost analysis works in DFMA.